November 19, 2008

Interesting post from Om Malik on GigaOm yesterday pointing out one of the problems with online video that people like me who believe online video is the game changer that VOD and iTunes could never be often gloss over. After trying too hard to find and finally watch a jerky, freezy 60 Minutes interview with Barak Obama, Om rightly says:

There are too many points of failure when it comes to web video. These problems are only going to increase in the near future as more and more of us are going to watch more and more video online.

He’s right, of course. You and I are watching an average of 56 minutes of online video a week. That’s only 3.5% of our total viewing minutes, but it’s rising. The longer you do it, the more likely you are to do it a lot. And once you start watching full-length TV shows online, forget it, you’ll blow right past 56 minutes into 2.5 hours-per-week land.

People at Akamai have been warning me about this forever. They have their hands on 25% of all the web content in the world. And they see that more online video + more of it at HD (let’s admit, 720p) resolution will take network congestion to new depths. As rhapsodic as I wax about the potential of online video (and I need to confess, in our home we watch at least 10 hours of online video a week between Hulu, Netflix, YouTube, and a million viral videos my kids and my wife come across), it is true that it can be spectacularly bad.

Take last night, for example. I recently had been treated to an early preview of some movie trailers at a meeting with Paramount marketing execs. I came home to report to my family on the best of them, including the terribly tasteless but funny Dance Flick. So when the preview finally hit the web, they were eager to check it out. I wasn’t home to witness it, but I was told it was a disaster. The video stuttered and stopped so often that they didn’t come away thinking the movie was nearly as funny as I did, after watching it in large screen glory in a private conference room.

And that’s one of the issues hanging over us: when the video stops and starts, our brains don’t engage the content as fully. The benefits of the medium are lost on us. Advertisers don’t get the intended benefit, content producers suffer from the inability to reach us with their creative output. Oh, yeah, and it’s annoying.

What do you think? Are you generally satisfied with the quality of video you’re watching online? Does it work as well as you think it should?

4 Comments |

4 Comments |  HD video, Online TV shows | Tagged: 60 Minutes, Akamai, Dance Flick, GigaOm, Hulu.com, iTunes, Netflix, Om Malik, Paramount, VOD, YouTube |

HD video, Online TV shows | Tagged: 60 Minutes, Akamai, Dance Flick, GigaOm, Hulu.com, iTunes, Netflix, Om Malik, Paramount, VOD, YouTube |  Permalink

Permalink

Posted by James

Posted by James

November 7, 2008

Very interesting piece posted on Dealerscope this week authored by the Senior Director of Market Research for CEA, Tim Herbert. It’s based on a survey the CEA did about future TV tech. Very interesting results. Let’s start with the obvious first:

Click on image to see bigger version

We do surveys like this as well and I’m going to give you the benefit of years of experience on this one. Here’s what people really want from their next TV: bigger and louder. Yep, it’s that simple. When they say better picture quality, they don’t mean 1080p (though that’s what they’ll buy because it’s quickly dominating the shelves at Best Buy). They just mean big and bright and loud.

Top on the list was energy efficiency. Let’s be honest about what this means — people are supposed to say that. But they won’t pay extra for a TV that saves energy. Next. The really interesting things they asked about were connectivity related: wireless connectivity with DVD players, ability to connect family photos, and internet connectivity.

Here’s the problem with asking about Internet connectivity (and I’m sure Tim knows this, I’m not implying he doesn’t). People don’t know what that means. Perhaps if you spell it out for them: “Hey, you could watch Hulu on your TV” the number would go up by 10 or 20 percentage points (which would put it in the top 3, I suspect).

Personally, my bet for the feature we’ll see most on the TV in the next 3-5 years is Internet connectivity. I’ll even predict that in 2012, 40% of all TVs sold will have connectivity built in. It will become so critical to TV makers that by then it will be standard equipment. Not only to deliver services but to upgrade firmware as needed. More on that later.

My favorite graph from this study was this one:

click on image to see bigger version

The question of 3D TV has been hovering over the market for a few years now. I saw 3D displays at CES this year and I think they are absolutely fun and enjoyable — to watch one or two movies a year. But as for buying one for the living room, the tech isn’t there yet. Overall, you can see that people don’t do a lot of thinking about what kind of technology should be in their TVs in the future. One that CEA missed was a mirrored screen so that a flatscreen TV can be an attractive mirror when not in use. That will be more important to people than they could say in a survey.

Leave a Comment » |

Leave a Comment » |  HD video, Predictions, Video to the living room | Tagged: 1080p, Dealerscope, Hulu.com, Tim Herbert |

HD video, Predictions, Video to the living room | Tagged: 1080p, Dealerscope, Hulu.com, Tim Herbert |  Permalink

Permalink

Posted by James

Posted by James

October 30, 2008

Quick post just to let you know that today I officially launched the “Everywhere Video” contest. Where have you come across an unexpected video screen? In the back of a taxi? At the gas pump? In the halls of your kid’s middle school?

One of the key predictions of OmniVideo is that an explosion of screens is about to occur. My former colleague and wonderful idea-man, Chris Charron, used to talk about the “Screening of America,” and we’re now seeing it come to fruition. There are more screens than ever before, being used in traditional ways and some surprising ways.

I’ve posted on a few of these, like a full-motion ATM video screen in NYC that runs ads when not in use for banking. But there are more, and my challenge to is is to find them and tell me about them. Go to the “Everywhere Video” contest page to see how to enter and win the grand prize, a Flip Mino digital video camera.

I’m very pleased to welcome Jason Kilar, the CEO of Hulu.com and Daisy Whitney of TV Week and the New Media Minute video blog as my co-judges. We’re ready to sort through the best you’ve got. And if you’re concerned someone else already did yours, you can still win an honorable mention prize for having the most valid entries or the most creative submission. Go forth and compete!

Leave a Comment » |

Leave a Comment » |  Everywhere Video, OmniVideo defined, Video in unusual places | Tagged: Chris Charron, Contest, Daisy Whitney, Flip camera, Hulu.com, Jason Kilar, New Media Minute, TVWeek |

Everywhere Video, OmniVideo defined, Video in unusual places | Tagged: Chris Charron, Contest, Daisy Whitney, Flip camera, Hulu.com, Jason Kilar, New Media Minute, TVWeek |  Permalink

Permalink

Posted by James

Posted by James

October 29, 2008

It’s not really a birthday party, since this is only the anniversary of Hulu.com’s beta launch. Which is all the more amazing considering how far it has grown in a year — when half of that year was conducted in private beta. Since its official launch in March, Hulu can now boast that in September nearly 150 million videos were streamed.

This is phenomenal, it’s precisely the year-end target I had for Hulu in December. Now I have to ratchet that up to 200 million. To go from 0 to 200 in under a year is remarkable. Consider that in its best months, Comcast VOD streams 300 million video views. That’s a big number. Hulu will be at the level some time next year. Without having to invest in VOD servers the way Comcast did.

That’s right, folks, Hulu is here to stay. And <bashfully> I have to admit I called it. A year ago today, I published a report called Online Video Syndicator Hulu.com Overperforms At Beta Launch. I said:

Today Hulu.com, the NBC Universal and News Corp. online video joint venture, launched a private beta test that beats our expectations of what the company would achieve. It syndicates video, enables sharing, and does it all with top-notch content and a design flare reminiscent of Apple. If Hulu can keep expenses down, the company stands as a threat to competing online TV companies like Joost, as well as old-line cable companies and telco TV entrants.

Specificallly to cable companies, I warned:

Cable companies and telco TV providers can begin the fear watch. By delivering a solution that advertisers want, syndication partners are happy to implement, and consumers will easily lap up, Hulu has assembled an experience directly comparable to that offered by cablecos and telco TV companies. Think about it: You have first-run TV shows, classic TV reruns, and movies from the back catalog. All you need is a pay-per-view option for new releases, and you might as well call Cox Communications, Time Warner Cable, or any of the rest and cancel your TV subscription while simultaneously opting for the fastest Internet connection they can possibly offer. That tells us what Hulu will offer next.

Cable companies and telco TV providers can begin the fear watch. By delivering a solution that advertisers want, syndication partners are happy to implement, and consumers will easily lap up, Hulu has assembled an experience directly comparable to that offered by cablecos and telco TV companies. Think about it: You have first-run TV shows, classic TV reruns, and movies from the back catalog. All you need is a pay-per-view option for new releases, and you might as well call Cox Communications, Time Warner Cable, or any of the rest and cancel your TV subscription while simultaneously opting for the fastest Internet connection they can possibly offer. That tells us what Hulu will offer next.

The warning is only stronger now as Hulu has even more content than it had back then and even more advertisers lining up to pay a premium on a CPM basis to participate. I hate to say I told you so…

Ironically, Comcast is a beneficiary of the Hulu experience since Hulu is the engine behind most of the content available at Fancast.com, Comcast’s online TV portal play.

What about you? Are you a Hulu.com junkie yet? Are you doing just TV or have you browsed any of the hundreds of movies? I’m hooked on both. I’ve watched over 3 hours of video just on Hulu this week alone. That puts me squarely in the most engaged online viewer category and I have Hulu to blame.

1 Comment |

1 Comment |  Online TV shows, online video advertising, Predictions, Video to the living room | Tagged: Comcast, Fancast.com, Hulu.com, Joost |

Online TV shows, online video advertising, Predictions, Video to the living room | Tagged: Comcast, Fancast.com, Hulu.com, Joost |  Permalink

Permalink

Posted by James

Posted by James

October 29, 2008

The details are still coming together, but while I was busy at the Forrester Consumer Forum, this little tidbit came out, as trumpeted by Gigaom via the New York Times.

Yes, I knew that the new UI for the Xbox 360, due out in late November, was going to feature Netflix streaming. That wasn’t news. But the interesting bit is that apparently, there will be HD movies as part of the deal. Reactions are quite positive so far, from the tweets I’m reading on Twitter. UPDATE: It appears Netflix has plans to roll this out to all its non-PC streaming platforms, not just Xbox 360 — read this post at CNET for details, including the high bandwidth requirements.

And I have to say that while this is a good move, and a relatively easy move, it’s more of a symbolic victory than anything else. For Netflix, the symbolic victory comes in being able to say it will be streaming HD quality movies to the TV not the PC (Hulu.com already streams hundreds of movies to the PC), something that cable companies charge much more for. For the Xbox 360, it will finally elevate the device’s chances of breaking through as a gaming machine to a home entertainment machine. When you add up how many people have watched video on the Xbox 360 — Microsoft says its about 30% of it’s 14 million Windows live customers, or more than 4 million people — that makes it more important than TiVo or the Apple TV in terms of the number of people it’s reaching, as I’ve said before. So going this next step makes sense.

But the move won’t push either company into new revenue or subscriber growth mode. Instead, it will confirm existing subscribers and remind them why they have already signed up in the first place. That’s always a worthwhile goal, especially in a recession, but a modest one.

It’s the long-term effect I’m interested in and I suspect that’s what Netflix is positioning for. Today, when you want to watch a movie, what are your top 5 choices? How different will that list be in two years? Maybe the better way to ask it is, where did you get the last 5 movies you watched? For me, without straining too hard to recall, it’s probably:

- Hulu.com streaming (watched bits of John Carpenter’s The Thing just yesterday while eating room service)

- Netflix by mail

- DVD rental from Hollywood video (it’s like, 2 mins away)

- Netflix streaming to Roku box

- Little bits of a movie my daughter was watching on ABC Family.

Here’s what’s not on my list even though I have these options: Apple TV, Xbox 360, premium movie channels, or cable VOD. What’s your five? Go on, surprise me:

Leave a Comment » |

Leave a Comment » |  DVD rental, HD video, Set top box, Videogame consoles | Tagged: Apple TV, Costco, DVD rental, Hollywood Video, Hulu.com, movies, Netflix, Roku, VOD, Xbox 360 |

DVD rental, HD video, Set top box, Videogame consoles | Tagged: Apple TV, Costco, DVD rental, Hollywood Video, Hulu.com, movies, Netflix, Roku, VOD, Xbox 360 |  Permalink

Permalink

Posted by James

Posted by James

October 28, 2008

Welcome to Forrester’s Consumer Forum, in Dallas. We’re off to a bang, I have just finished my keynote speech a few minutes ago and now Cameron Death, VP of Digital Content at NBC Universal is speaking.

He put up a slide that I didn’t get to capture with my BlackBerry in time, but it showed the number of people who caught the Heroes season premiere. It was something like 24 million in broadcast (probably including DVRs), 8 million online, and just about 126,000 people in mobile and VOD. Just 126K! Online is hot, the rest is not. (Now if only Heroes had been as good as it was in season 1!).

He is so refreshingly open! My experience with TV execs is that they are very guarded. Perhaps because Cameron is an ex-Microsoft guy who has only been at NBC for a year, he is talking very openly about ratings, DVRs, and other challenges. And he’s very optimistic. Perhaps it’s because NBC is doing very well right now in the online space. NBC’s joint venture with Fox, Hulu.com, is a roaring hit. NBC is having a huge rush online thanks to Sarah Palin/Tina Fey.

In fact, in a very surreal moment, Cameron read from today’s USA Today which was delivered to his hotel room here at the Gaylord Texan. He quipped, “it’s interesting there are numbers in here, because I wasn’t given permission to share these numbers, so I’ll just quote USA Today!”

Not only did SNL get its largest TV audience (15 million) in 14 years for the October 18 broadcast with vice presidential candidate Sarah Palin watching Tina Fey impersonate her, but Palin-related SNL skits have been viewed more than 63 million times across the Web… – October 28 paper, Section D, page 1 (update note: originally had incomplete quote here, replaced it with full quote once I had a copy of the paper)

Cameron pointed out that this is clear evidence the digital channel matters, driving not only online activity that dwarfs the broadcasting viewing, but also lifts the broadcast viewing itself.

The forum is shaping up well. I’ll prepare a summary of my speech a little bit later, with some screen shots because there’s some good stuff in there worth talking about. If you want to follow the forum on Twitter, follow “forrester.” I’m also twittering at jmcquivey.

Leave a Comment » |

Leave a Comment » |  conference, Network TV, Online TV shows, Speeches | Tagged: Cameron Death, Forrester Consumer Forum, Fox, Hulu.com, Microsoft, NBC, Tina Fey, Twitter, USA Today |

conference, Network TV, Online TV shows, Speeches | Tagged: Cameron Death, Forrester Consumer Forum, Fox, Hulu.com, Microsoft, NBC, Tina Fey, Twitter, USA Today |  Permalink

Permalink

Posted by James

Posted by James

October 21, 2008

It’s not the most amazing insight I came across today, but it is worth pointing out and commenting on. MediaPost yesterday ran a piece about the role of vide on media company websites, see it here: Video Use Will Continue To Rise, Per Web Influencers – 10/20/2008.

The gist of the story is that video is rapidly becoming a critical tool in the online sites of even non-video media companies like newspapers and magazines, half of which — according to the study cited in the article — feature video on their sites.

This is something we’ve been writing about for a while at Forrester, and I spent some time on it at Forrester’s Marketing Forum in LA earlier this year. It’s Phase 2 of what I called a 3-Phase evolution of online video. Phase 1: media companies with video assets and audiences combine the two online. Phase 1 started with ABC.com and came into full view with Hulu.com. Done. Phase 2 is the one we’re in now where media companies with non-video assets but considerable audiences supplement their content with video.

The slide describing the 3 phases of online video growth

This started a while back with sites like MarthaStewart.com, which added a very integrated video experience in early 2007. It still continues today as more and more newspaper outlets equip their journalists with cheap little video cameras and train them to capture video while they’re in the field. (This is a broadcast technician’s worst nightmare, all these people capturing video without a real knowledge of what makes for quality video, including lighting, white balance, etc., but as YouTube has shown, web viewers don’t notice or don’t care.)

Phase 3 is when marketers start producing significant video content that begins to compete with the media outlets. We see this already with Land Rover’s Go Beyond site, a fairly ambitious multimedia content site built around the brand. But there are precious few marketers committed to this kind of video experience on the Web just yet. I just spoke to a major financial service company last week who is trying to plan what technology they’ll use to support online video, but they confessed they didn’t really expect to have much video to watch — or many viewers to watch it.

That will change.

Leave a Comment » |

Leave a Comment » |  conference, Predictions | Tagged: ABC.com, Forrester Marketing Forum, Hulu.com, Land Rover, MarthaStewart.com, MediaPost, video quality |

conference, Predictions | Tagged: ABC.com, Forrester Marketing Forum, Hulu.com, Land Rover, MarthaStewart.com, MediaPost, video quality |  Permalink

Permalink

Posted by James

Posted by James

October 16, 2008

The New York Times did a piece this week on Nielsen’s release of adjusting ratings that take into account DVR viewing. I love this last paragraph paraphrasing Alan Wurtzel, president of research at NBC:

[Alan] called the DVR the “ultimate frenemy” (friend and enemy) because it increases overall viewing and demonstrates that viewers are engaged enough with shows to plan ahead and record them, but “the enemy part is that there is still a lot of commercial avoidance.”

So true, so true. What’s interesting is that he’s now open to the friend part of the Frankenword “frenemy.” Remember, just two years ago, people like Alan thought DVR was the ultimate evil. We still have former clients of Forrester who refuse to engage with us because we had the audacity to (correctly) forecast that DVR use would be near 30% by now. Gee, we’re sorry we hit that nail on the head. We’ll try to be wrong next time. [yeah, you know who you are]

The ratings numbers from Nielsen revealed that hot, upscale shows like House, Fringe, and Heroes, all added an additional chunk of viewers via DVR.

House, for example, added 3.7 million additional viewers. Among 18-49 year olds, Heroes went up 42 percent. That means nearly a third of its viewers in that target age range were watching via DVR.

And let’s not forget the viewing that’s happening online. Remember that? It’s even easier to do than watchingvia DVR. And in a recession, online viewing seems a lot cheaper than paying for a DVR. For shows like Fringe or Heroes, I could imagine that 50% of all viewing is now happening on-demand, whether via DVR or Internet. Here’s a prediction for you:

- Online viewing will account for more views than DVR viewing by year-end.

Two factors will drive this. First, more people can and do watch TV shows online than have a DVR. Second, it is less of a hassle — there’s nothing to program, no disk to keep uncluttered with episodes of Suite Life of Zach and Cody (sorry, went on a personal tangent there).

Leave a Comment » |

Leave a Comment » |  DVR, Network TV, Online TV shows, Predictions | Tagged: Alan Wurtzel, DVR, Heroes, House, Hulu.com, NBC.com, Nielsen, ratings, Suite Life of Zach and Cody |

DVR, Network TV, Online TV shows, Predictions | Tagged: Alan Wurtzel, DVR, Heroes, House, Hulu.com, NBC.com, Nielsen, ratings, Suite Life of Zach and Cody |  Permalink

Permalink

Posted by James

Posted by James

October 15, 2008

As I have been promising/threatening, yesterday I completed my take on how a down economy will affect various types of video in the home. Forrester clients can read the full analysis here.

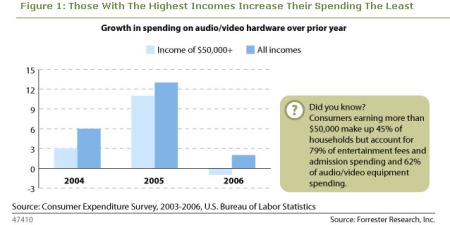

Something I can share with everyone, client or not, is an interesting analysis I did on consumer spending on audio/video hardware. One of the questions I wanted to answer was what % of entertainment spending do affluent consumers account for. It turns out, a lot. In fact, the 45% of US households that earn more than $50K a year account for 79% of entertainment “fees and admissions” and 62% of audio/video equipment spending. That’s a lot. Interestingly, these wealthier consumer have been increasing their spending on audio/video tech less aggressively than average over the past few years.

I get all of this from the Bureau of Labor Statistics’ Consumer Expenditure Survey (a datasource which, if you know how use it, can answer many of life’s most important questions, and it’s all free).

Just as Jefferson famously said that “the tree of liberty must, from time to time, be refreshed with the blood of patriots and tyrants,” it is similarly true that technology markets must, from time to time, be challenged with a lackluster economy. Not quite as big a deal, but you get my point.

Overall, the losers are new technology platforms like standalone Blu-ray and premium content subscriptions. The winners — at a very critical time for all involved, I might add — are free online video services like Hulu.com and Fancast, including Netflix’s streaming services, newly enriched with additional content. So while Netflix has warned it won’t hit 9 million subscribers as originally hoped in 2008, the millions it does have will rely on the service more than before.

3 Comments |

3 Comments |  DVD rental, economy, HD video, Online TV shows, Video to the living room | Tagged: Blu-ray, consumer electronics, Consumer Expenditure Survey, Fancast.com, Hulu.com, Netflix, recession |

DVD rental, economy, HD video, Online TV shows, Video to the living room | Tagged: Blu-ray, consumer electronics, Consumer Expenditure Survey, Fancast.com, Hulu.com, Netflix, recession |  Permalink

Permalink

Posted by James

Posted by James

October 14, 2008

In October 2007, my very smart colleague Shar VanBoskirk, a principal analyst serving Interactive Marketers, authored our 5-year interactive marketing forecast. For the first time, she was able to break out online video separately from display ads and other interactive marketing avenues.

I won’t give away her hard-earned insight here beyond saying that in 2007, our forecast pegged the online video advertising business at $471 million, at least half of which — in my estimation — came from the 2007 advertising upfronts, where the networks aggressively bundled in online advertising to keep the broadcast ad numbers from flattening.

This forecast for 2008 put the number at double that — $989 million, close to the magic threshhold of a billion. Throughout the year I have been asked whether we think the assumptions of the model have held up. My answer is no: some assumptions fell below expectations and others came in above, chiefly:

- YouTube hasn’t monetized its traffic effectively enough yet. This magic vein of cash has yet to be properly tapped. We saw an interesting interim announcement on how YouTube can add some cash through click-to-buy, but it’s really advertising that can bring in the dough once YouTube figures out how to make money without Viacom asking for all of it in the form of damages. Result: online video ad revenue not as big as you would hope.

- Online TV is bigger than expected. Remember, watching TV online is something that in 2006, only 10% of online video viewers did. By the end of 2007, it was 24% (see the report “What It Really Means To Watch TV Online”), a number we did not have in time to feed Shar’s forecast. Looking at the increased supply of online video — most of it from Hulu.com which increased supply both in amount of content and the breadth of distribution — that 24% number should double this year.

The point is that even though YouTube didn’t come through for us, online TV has certainly more than made up for it, largely because the CPM on those shows is so awesome, ranging from $30 – $60 on a CPM basis.

As a result, we stand by this number. As part of the validation exercise, I went through the following logic (which is summarized in the context of other valuable online video statistics in my Online Video FAQs):

- In a typical week, 109 million hours of online video are watched.

- If every hour of video has an average of 10 ads in it (video or companion banner), that means that just over 1 billion video ads are served each week, a run-rate of nearly 57 billion ads a year.

- To hit our forecast of $989 million, the average CPM on the 57 billion ads run has to be $17.45

The big assumption here is the number of ads per hour. For long-form content, 10 seems a tad high as a 45-minute episode usually has 6 ads. But add in another 2 ads for the whole hour and the possibility of a few pause ads and companion banners and the 10 assumption is reasonable.

The real question is the CPM. For long-form content, that’s easy. For short-form content, overlay and companion banner ad CPMs can fall below a buck if sold as remnant inventory on an ad network. What do you think? Will online video ads hit this mark? Why or why not? What evidence do you have or signs do you see? I’m interested in your comments.

3 Comments |

3 Comments |  Online TV shows, online video advertising, Predictions, Survey results, User Generated Content (UGC) | Tagged: Hulu.com, online video advertising forecast, online video CPM, Shar VanBoskirk, YouTube |

Online TV shows, online video advertising, Predictions, Survey results, User Generated Content (UGC) | Tagged: Hulu.com, online video advertising forecast, online video CPM, Shar VanBoskirk, YouTube |  Permalink

Permalink

Posted by James

Posted by James

Posted by James

Posted by James

You must be logged in to post a comment.